Rumored Buzz on Baron Tax & Accounting

Table of Contents8 Simple Techniques For Baron Tax & Accounting4 Simple Techniques For Baron Tax & AccountingBaron Tax & Accounting - QuestionsThings about Baron Tax & Accounting8 Simple Techniques For Baron Tax & Accounting

And also, accountants are anticipated to have a respectable understanding of mathematics and have some experience in a management duty. To become an accounting professional, you need to contend the very least a bachelor's degree or, for a higher degree of authority and expertise, you can end up being an accountant. Accountants have to likewise satisfy the strict demands of the accountancy code of method.

The minimum credentials for the CPA and ICAA is a bachelor's degree in accounting. This is a beginning factor for refresher course. This makes certain Australian local business owner obtain the finest possible monetary recommendations and monitoring feasible. Throughout this blog site, we have actually highlighted the huge distinctions in between accountants and accountants, from training, to duties within your service.

The Single Strategy To Use For Baron Tax & Accounting

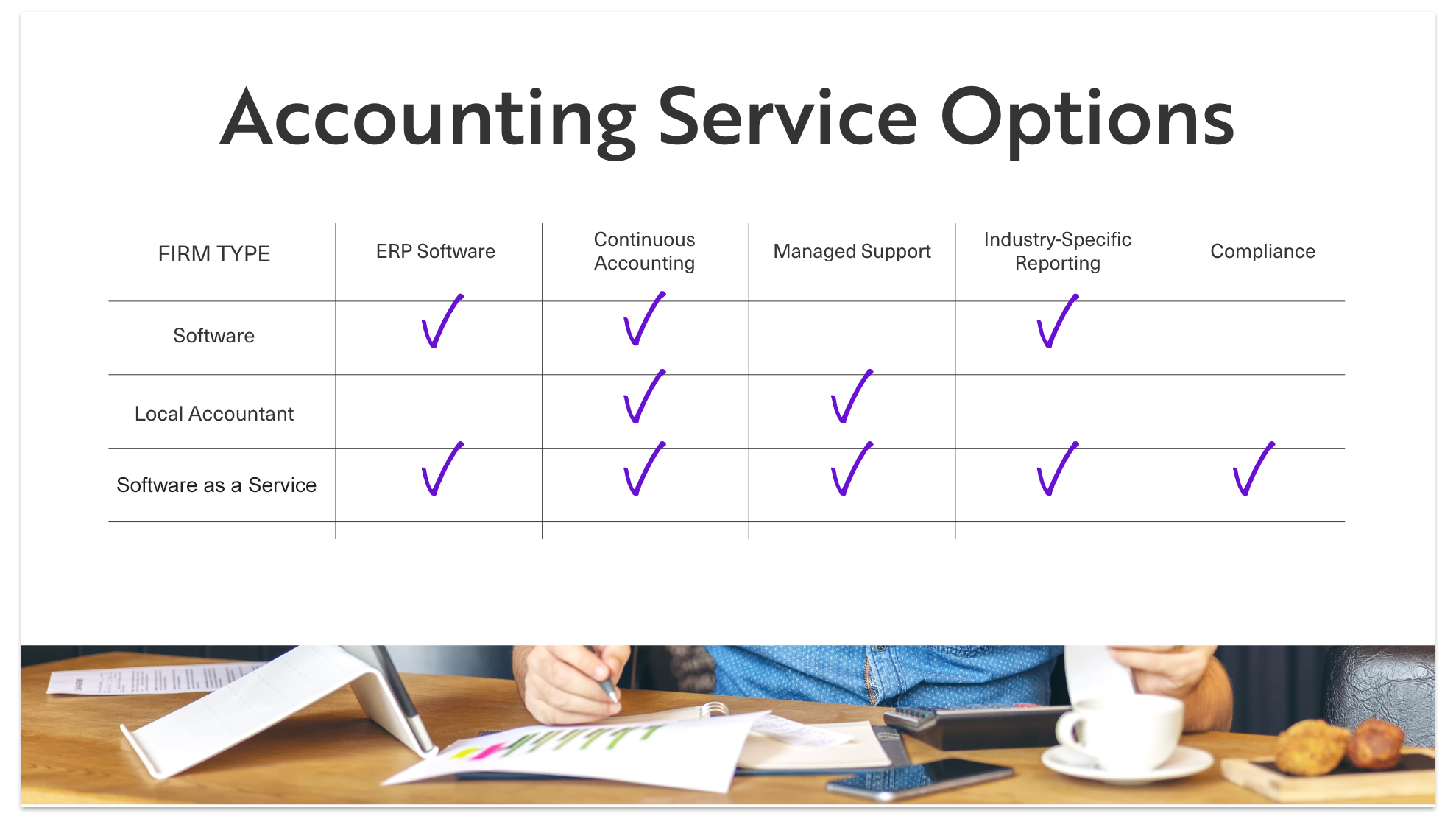

The services they provide can make best use of revenues and support your funds. Services and people need to think about accounting professionals a critical aspect of financial preparation. No accountancy firm supplies every service, so ensure your experts are best fit to your specific demands.

(https://al-auburn.cataloxy.us/firms/www.baronaccounting.com.htm)

Accounting professionals are there to calculate and upgrade the collection amount of cash every employee receives routinely. Keep in mind that holidays and sicknesses impact payroll, so it's an element of the business that you must constantly upgrade. Retirement is additionally a substantial aspect of payroll management, specifically offered that not every worker will certainly wish to be signed up or be eligible for your firm's retired life matching.

The Single Strategy To Use For Baron Tax & Accounting

Some loan providers and capitalists call for crucial, strategic decisions between the company and investors following the conference. Accounting professionals can additionally be existing here to aid in the decision-making process. Preparation involves issuing the revenue, money circulation, and equity statements to review your present monetary standing and condition. It's easy to see how complicated bookkeeping can be by the variety of abilities and jobs needed in the duty.

Tiny companies often read this post here deal with one-of-a-kind economic difficulties, which is where accounting professionals can offer invaluable support. Accountants supply a range of services that assist services stay on top of their financial resources and make educated decisions. Accountants additionally make sure that organizations abide by monetary laws, making best use of tax financial savings and reducing mistakes in economic records.

Therefore, professional bookkeeping aids stay clear of expensive blunders. Pay-roll administration includes the administration of staff member earnings and salaries, tax obligation reductions, and advantages. Accounting professionals make sure that workers are paid properly and on schedule. They determine pay-roll tax obligations, handle withholdings, and guarantee compliance with governmental guidelines. Processing incomes Managing tax filings and settlements Tracking employee advantages and reductions Preparing payroll records Proper payroll monitoring avoids concerns such as late settlements, wrong tax obligation filings, and non-compliance with labor regulations.

How Baron Tax & Accounting can Save You Time, Stress, and Money.

Small organization proprietors can count on their accountants to deal with complicated tax codes and laws, making the filing procedure smoother and a lot more efficient. Tax obligation preparation is another crucial service supplied by accountants.

These solutions typically concentrate on service evaluation, budgeting and forecasting, and cash circulation monitoring. Accounting professionals assist small services in determining the worth of the company. They evaluate possessions, responsibilities, earnings, and market problems. Methods like,, and are used. Accurate appraisal assists with selling the company, protecting finances, or bring in financiers.

Discuss the procedure and response inquiries. Take care of any type of inconsistencies in records. Overview local business owner on best techniques. Audit assistance helps companies experience audits efficiently and effectively. It decreases stress and mistakes, seeing to it that services meet all necessary laws. Statutory compliance entails adhering to laws and laws associated to company operations.

By establishing reasonable monetary targets, organizations can assign resources successfully. Accountants overview in the application of these strategies to guarantee they align with the organization's vision.

Some Known Details About Baron Tax & Accounting

They ensure that organizations comply with tax laws and sector policies to stay clear of charges. Accountants additionally suggest insurance plans that offer defense against possible dangers, ensuring the organization is secured against unanticipated events.

These devices aid small services maintain accurate records and enhance procedures. It assists with invoicing, pay-roll, and tax preparation. It uses many functions at no price and is suitable for startups and little businesses.